The Decline of Civilization or Building the Western Power Market?

The Decline of Civilization or Building the Western Power Market?

My academic background is in national security policy. My first “real jobs” were at the State Department working on security issues with our allies. Consequently, notwithstanding the dysfunction in Congress of late, I’m pained by Russian aggression in Ukraine and the horrors of terrorist attacks on Israel. I listen to podcasts and speak with former colleagues about what’s happening, but sometimes I miss the action of “serving” my Country. For me, America has a unique role to play in helping a “rules based” order work which, while it is helpful to allies, it also serves our national interest.

So, how do I scratch my itch to serve? For more years than I care to recount, it’s been helping with the pursuit of open, transparent, and competitive power markets. Most recently, trying to help the West get there. Do I do this for money? Not really, otherwise I would not have spent so much time as a regulator. For the West, the need is to help structure the region so we can boost reliability through better use of the existing grid, while also providing for the best economic outcomes for customers.

Day-Ahead Market Options better than status quo, but…

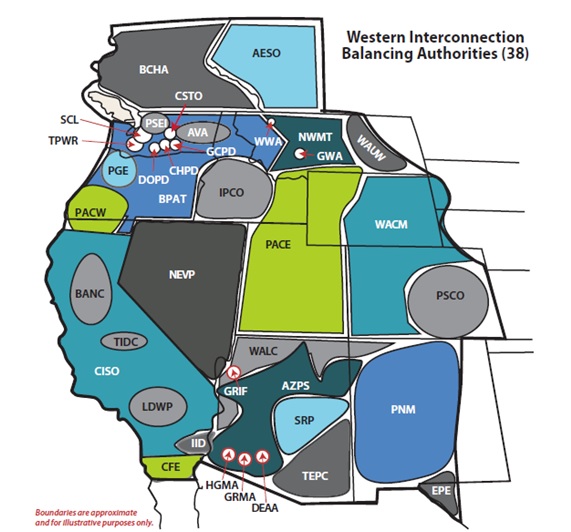

Back in 2014, when CAISO’s Energy Imbalance Market was just getting underway, the EIM was thought to be a precursor to a fully organized market like an RTO for much of the West. If not for the California legislature’s short sightedness in refusing to allow the CAISO to be governed by an independent Board, it is quite likely that a Western RTO, covering much of the region West of the Rockies, might be functioning now.

So, if it is not prudent to give “operational control” of utility transmission systems outside of California over to CAISO – whose Board is appointed by the Governor of California – how could the region capture some of the benefits of an integrated market? That is how the day-ahead market concept was borne. First at CAISO, then by a competing platform offered by SPP. The day-ahead market would – conceptually – provide many of the benefits of a broad regional network dispatch and the temporal expanse (day before) to make resource commitments in response to electric demand and system needs.

Now utilities and market participants would have a choice between system administrators. While this offers the opportunity for innovation, the choice of which day-ahead market to embrace could introduce inefficiencies depending on where the border of each market falls and whether there’s coordination between the two areas.

And unlike an RTO, which has one tariff to provide the rules for all wholesale activity, we’ll have a tariff for the day-ahead administrator and each participating utility will maintain its own “Open Access Transmission Tariff” (OATT). This complication is exacerbated by the fact that neither the CAISO offering (EDAM) nor the SPP option (Markets +) will require changes to participating utility OATTs to reflect changes to the day-ahead tariff. Uncertainty in rules rarely assists transparency or liquidity in a market. But I am assured by both CAISO and SPP that the day-ahead offerings should provide many of the benefits of a network dispatch – which would allow for a greater utilization of the existing grid than the bilateral, contract path and pathway rights operation that is the norm in the West outside of the CAISO.

The problem of “where the border” or “seam” between the two day-ahead markets has been, until lately, a largely academic issue. In the East the RTOs have managed the seams (mostly) successfully through agreements that facilitate the movement of resources across the seam known as “Joint Operation Agreements” or JOAs. However, based on observations from ongoing WPTF work, this coordination may not be easily achieved without the tools of an RTO, including the consolidated transmission tariffs and Balancing Authority areas. And, at the very least, the coordination between day-ahead market operators is made more complicated by the persistence of multiple transmission tariffs and entities operating the system.

Can we “have our cake and eat it too?”

People who are skeptical of moving ahead with an RTO often say they don’t want the problems with long interconnection queues that have bedeviled Eastern RTOs. Others cite the issues associated with transmission planning and cost allocation issues evident in RTOs.

In my mind, these aspects of Eastern RTOs are ancillary to what the real benefit and function of an RTO is - the full utilization of the grid. The main function of RTOs is to manage transmission when it’s scarce (congestion) to the least cost and maximal use over a broad area operated as “network”. If the objections to a Western RTO are interconnection and transmission planning process, then I have an alternative. A uniquely Western approach to a modified RTO which would:

- A single tariff for dispatching resources over the utility systems that agree to turn over operational control to a system operator that has independent governance (more on governance below).

- Transmission revenue expectations would be achieved through the assignment of transmission rights (call them FTRs, CRRs or TCCs) like other RTOs based on each participating transmission owner’s legacy usage. These rights could be sold or retained as decided by the transmission owner recipient.

- All transmission of participants above 100 kv would be under the operational control of the system operator (exceptions based on traditional network usage).

- Transmission planning could be accomplished outside the RTO (Northern Grid, Western Power Pool, etc.). However, any entities performing regional transmission planning should wish to access congestion data produced by the system administrator.

- Interconnection could continue to be under the OATT of participating utilities as FERC approved procedures but would be outside the purview of the system administrator of the “modified RTO.”

Governance

If this Western approach to a slimmed down RTO, with its benefit of a single tariff, is acceptable to a wide audience, we still need to tackle governance. Turning over operational control demands a structure that works with an owner’s fiduciary obligations. Certainly, an independent governance structure is achievable in some form utilizing the SPP approach suggested in Markets Plus. It might need to be altered to meet the needs of the West, but it has the basic elements in place.

The independent structure as utilized by the Western Power Pool (WPP) which made the switch from a stakeholder board when it was the Northwest Power Pool could be model for use in an RTO. However, adoption of this excellent model might have to be modified to give state authorities more of a defined role.

But what to do about California? Can a broad RTO with a single tariff be achieved while providing a meaningful commitment to making its current governance acceptable? Possibly, but it takes some imagination:

- CAISO receives permission from its Board to form a Limited Liability Company (LLC) to serve as system administrator for an RTO for utilities outside of California but with a responsibility to make this RTO function in a coordinated SCED with the existing CAISO network.

- This RTO would operate a single tariff network dispatch, but not take one transmission planning (except for any utility that might wish to opt into such a service) or oversee generator interconnection (to be governed under existing utility OATTs).

- Utilities that agree to join the RTO outside of California would have its own Board and governance structure based on its own tariff. The outside Board would have its own filing rights at FERC, but the LLC would have the obligation to coordinate the tariff along with the California Tariff for a period of two years after the start of operations.

- If a merged Board cannot be achieved through California’s adoption – by whatever legal means necessary – of an independent governance structure, then the contract for system operation of the RTO outside of California will be open to bids from other system operators (i.e., SPP, MISO, PJM, etc.).

Closing the Argument

Yes, CAISO and SPP’s day-ahead offerings are improvements for the West over the status quo. But each has limitations that will prevent what should be the goal: full utilization of the existing Western grid to assist with reliability, provide economic efficiency and allow for the better capital structure for new resource investments (prices allow for easier capital allocation). Many of the identified problems associated with Eastern RTOs can be avoided while getting the benefits of a single tariff, security constrained economic dispatch. Bottom line: We’ll be doing the prudent thing sooner, rather than later.